In 2023, the typical monthly wage in Australia is expected to be 7,570 AUD. Based on the currency exchange rate in April of 2023, that comes to about USD 5,032 every month.

Compared to the USA, where the mean earnings per month are USD 7,900, and the UK, where the mean earnings per month are USD 7,347, Australia has a lower average wage.

In this piece, we’ll discuss the minimum wage in Australia and the median and average incomes. We’ll also discuss typical wage increases and the variables that impact wages. Lastly, we’ll look at some of the highest-paying industries in Australia.

Let’s jump right in.

Where in Australia Can I Make the Most Salary?

Australia’s Capital Territory (ACT) is the best place to settle in Australia if you want to make a lot of money, especially in Canberra. The typical weekly wage in Canberra is $1,980 — $102,986 annually.

Western Australia, Australia’s second-largest state, pays its residents an average of $1,896 per week, equal to $98,582 annually.

Tasmanians earn the least wages, with a weekly wage of $1,542 and a yearly pay of $80,168. Learning basic Australian English ensures you can communicate with the people no matter where you settle down in Australia.

Pay Gap Between Men and Women in Australia

Across Australia’s territories and states, women earn a lower average income than men.

Western Australia has the largest income difference between women and men — probably because of its high number of miners, which typically pay males more.

Regarding average wages, the ACT remains the best option for both genders, whereas NSW is best for women. It’s worth a shot to negotiate a higher wage in Australia.

Which Professions in Australia Offer the Highest Pay?

As of November 2021, Australia’s mining industry positions are among the country’s best-paid. The average compensation for males in this field is a stunning $141,695, but the average salary for women is still quite acceptable at $119,928.

Central and North Western Australia is rich in mining employment opportunities, contributing significantly to the state’s high total income. Following this comes telecommunications and information media opportunities and finance and insurance Industries.

Data analysts may expect an annual salary of $103,177, while investment consultants earn $117,482.

The average annual salary for building inspectors is $98,659, while electrical engineers can earn $113,410. In all jobs in the country, you must learn English for the interview.

In 2022, What Would Be a Fair Wage in Australia?

The national median household income is $91,000. Thus, full-time workers who make more than that are well over average.

Although this figure varies widely by location, occupation, gender, level of education, and years of experience, it is often between $25,000 and $50,000 per year.

For example, software engineers in Sydney can count themselves successful if their annual income is over $115,000. However, a female public sector employee must make over $1,820 weekly to be considered successful.

The salary of a chief executive officer in Sydney is $308k, whereas, in Melbourne, that same job earns only $235k.

Employees in highly competitive professions having years of expertise deserve an annual salary of over $120,000, while fresh employees are likely to make roughly $4,000 to $5,000 monthly.

Generally speaking, you should shoot for at least the mean wage. A good salary in Australia might be anything from AU$ 90,000 to AU$ 108,000.

A decent benchmark for what you should make is the median salary of $72,000 per year.

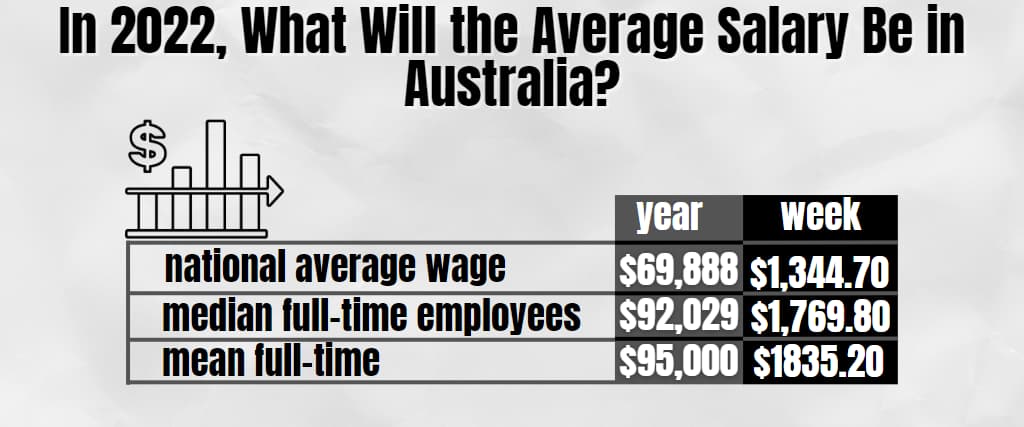

In 2022, What Will the Average Salary Be in Australia?

According to the most recent data by the Australian Bureau of Statistics, the national average wage is $69,888 per year, or $1,344.70 a week.

The median annual salary for full-time employees is $92,029, an increase of 1.9% over the previous year. This equates to a weekly wage of $1,769.80.

The mean full-time pay is $1835.20 per week, or $95,000 per year (before taxes), excluding commissions, bonuses, and overtime.

For full-time employees (those putting in more than 38 hours per week), the starting salary is $812.60. Employers are legally obligated to provide their workers with at least the minimum wage and make superannuation contributions on their behalf.

Information About Wages in Australia

- There was a 50% increase in weekly earnings to a median of $1,200.

- The median hourly wage in Australia has been steady at $36 from 2020.

- Australia’s public sector workers typically receive higher compensation than private-sector workers.

Therefore, full-time workers in the private sector earn an average of $1,725 per month, while those in the government sector earn an average of $1,936 monthly, giving an overall average wage of $1,277.

- In the construction business, wages increased by 3.4% annually. The industry employs more than a million people in Australia.

- The ABS report from June 2022 shows that Western Australia recorded the most significant quarterly increase (0.8%). Northern Territory employees recorded the lowest rate in the country at 0.3%.

- Workers with 2-5 years of work experience earn roughly 32% more than their juniors, while those with ten to fifteen years of work experience make 21% and 14% more, respectively.

- After 16 months, employees in Australia receive an 8% raise in pay. Salaries for upper-level managers might increase by up to 20% per year.

- Professionals and managers in Australia earn the most money per hour (52.40 AUD and 50.20 AUD, respectively). Workers at the bottom of the pay scale, such as cashiers and dishwashers, earn a minimum hourly salary of $21.38.

Statistics and Trends on the Mean Australian Wage

The median income for Australians is AUD 90,800 ($60,355) per year.

So that you thoroughly understand wage trends and statistics in Australia, let’s go over a few significant indications of the mean salaries earned in Australia.

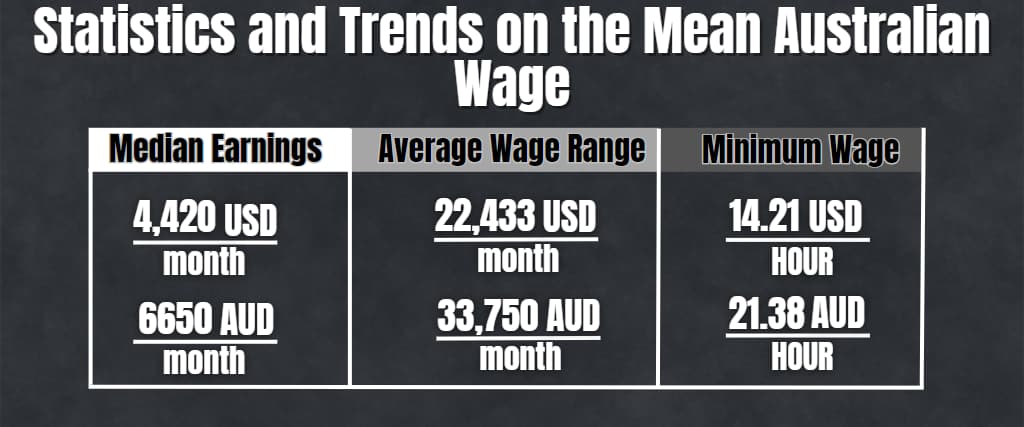

Median Earnings

In 2023 the median Australian wage is expected to reach about USD 4,420 or 6650 AUD per month.

The median pay is the wage that falls in the middle of all the numbers used. In other words, almost half of Australians live on less than 6,650 Australian dollars per month, whereas the remaining half live on more.

Average Wage Range

The monthly salary in Australia can start at around AUD 1,917 ($1,274) and go up to around AUD 33,750 ($22,433).

These are rough estimations, though. The lowest monthly wage in Australia is less than 1,917 AUD, and the highest monthly salary in the country is more than AUD 33,750.

Minimum Wage

The Australian Bureau of Statistics reports that the minimum hourly salary in Australia is 21.38 Australian dollars (about $14.21 US dollars).

Interestingly, Australia’s minimum salary exceeds America’s (USD 7.25).

The UK’s minimum wage is GBP 10.42 ($12.93), still increasing Australia’s basic wage.

Note:

This is the bare minimum an Australian employer must offer a part-time or full-time employee. The Fair Work Commission states that it is illegal for an employer to include a wage provision that is less than the legal minimum wage.

The Fair Work Commission arbitrates conflicts in the workplace.

Employer contributions to employees’ superannuation funds are also required by law in Australia. Superannuation means a worker’s retirement pension along with additional benefit money.

Where do we stand on pay increases in Australia?

The Australian Bureau of Statistics reports that the minimum wage in Australia has increased enormously over the previous year, rising from 20.33 to 21.38 Australian dollars per week.

Pay Raise Percentage Every Year

In Australia, workers may anticipate an average pay raise of 8 per cent every 16 months.

An annual pay increase occurs once per year. It’s not uncommon, though, that a worker will see a pay raise coincident with completing their first year on the job.

However, this number shifts depending on the industry and the employment contract terms.

Salary Estimate for Australia, 2022

Several factors affect the median monthly income in Australia, as mentioned above. This table compares Australia’s median annual household income by gender, occupation, and region.

Remember that these are rough estimates, as your compensation will depend on various other variables.

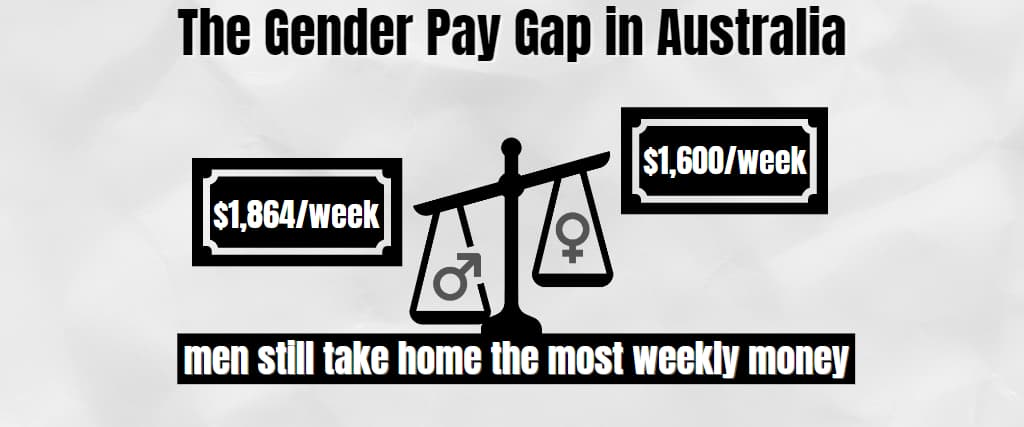

The Gender Pay Gap in Australia

Even though women’s wages have increased quicker than men’s, men still take home the most weekly money. Therefore, men make an average of $1,864 per week, and women an average of $1,600.

This further proves that women everywhere face a pay gap.

Due to the abundance of mining employment opportunities, where males often earn higher wages, WA has the most significant gender pay disparity in the country. The wage difference between women and men is the smallest in the ACT.

NSW is ranked the second-best region for working women because wages are above average. In addition, the compensation is open to discussion.

Because they undertake more of the unpaid caregiving and housework, women experience disproportionate hardship.

See what average women and men in Australia made during the preceding five years. Salary parity between men and women is slowly closing, but only slowly.

| Year | Men (in USD) | Women (in USD) |

| 2018 | 1,736 | 1,513 |

| 2019 | 1,768.7 | 1,550.62 |

| 2020 | 1,830 | 1,640 |

| 2021 | 1,878 | 1,688.8 |

| 2022 | 1,920 | 1,750 |

What Is the Average Income for Someone By Age?

In Australia, one of the major factors in determining salary is age.

A person’s salary will increase as they get older. The peak earning age in the country is between 45 to 55. Since most young people have part-time or temporary jobs while in school, this implies they are at a disadvantage financially.

Despite the robust labour market, young people face discrimination that prevents them from gaining better career possibilities.

Here is a rough estimate of monthly income by age group:

| 20 years and below | 381.5 USD |

| Between 21 to 34 years | 1,128 USD |

| Between 35 to 44 years | 1,500 USD |

| Between 45 to 54 years | 1,545 USD |

| 55 and above | 1,375USD |

Salary Levels Across Australia, on Average, by Territory and State State.

It’s no surprise that average wages are greater in states with higher standards of living.

As a result, the mean yearly salary in ACT, where Canberra’s civil officials reside, is 103,080 USD, about $19,000 more than in SA, where earnings are, on average, $84,390.

Here is a closer look at salary differences amongst states.

| State | Mean weekly earnings in USD | Mean yearly earnings in USD |

| ACT | 1,983 | 103,152 |

| Western Australia | 1,937 | 100,724 |

| New South Wales | 1,790 | 93,080 |

| VIC | 91,036 | 91,036 |

| Northern Territories | 1,710 | 88,935 |

| Queensland | 1,705 | 88,665 |

| Southern Australia | 1,622 | 84,390 |

| Tasmania | 1,568 | 81,536 |

According to the data, Australia’s Nothern Territory and Queensland are the only two states where full-time workers’ annual earnings are close to the national average.

Can you name the top five industries in Australia in terms of salary?

The five highest-paying industries in Australia are:

| Industry | Average earnings per week | Average earnings per year |

| Mining | 2,701 USD | 140,478 USD |

| Information Technology | 2,236 USD | 116,287 USD |

| Finance and insurance services | 2,148 USD | 111,722 USD |

| Scientific, Technical & Professional services | 2,081 USD | 108,258 USD |

| Electricity, Waste, Water & gas services | 2,014 USD | 104,748 USD |

According to this table, the five highest-paid occupations in Australia all have higher salaries than the national average.

In the Mining business, 83% of workers are men — earning $444 more annually than women. Although women comprise most of the health care and social support workforce, males make $2.049 more annually than women ($1,595).

The most negligible average weekly wage is in the lodging and food services sector, at $1,220. It also has the youngest workforce, 45% of workers under 25.

Income Distribution by Level of Education

A person’s salary in Australia may vary depending on their level of education. Workers with more education might expect a greater salary than those with only a high school diploma.

Here are the average earnings for August 2021, broken down by education level.

| Level of education | Median earnings per week | Median earnings per year |

| Postgraduate degree | 1,747 USD | 90,844 USD |

| Graduate Diploma | 1,600 USD | 83,200 USD |

| Bachelor degree | 1,428 USD | 74,256 USD |

| Advanced Diploma | 1,207 USD | 62,764 US |

| Certificate III/IV | 1,000 USD | 52,000 USD |

| Certificate I/II | 900 USD | 46,800 USD |

| Non-school qualifications | 800 USD | 41,600 USD |

Naturally, those with Doctoral or master’s degrees earn more than those without, yet, these degrees are expensive. The annual cost of postgraduate courses in Australia ranges from $37,000 and $114,000.

However, it’s important to remember that there exist occupations you may do without a degree or prior experience that can pay well.

Jobs that pay much above standard wage but do not necessitate a college degree include airline controller (257,000 USD) and construction supervisor (153,000 USD), among others, such as concrete mixer (109,200 USD) and shipping driver (USD 27,400).

Jobs Here in Australia With the Highest Pay

Surgeons have the highest salaries in Australia, more than double the national median income.

Here’s a deeper dive into the top 5 highest-paying professions in Australia.

| Job | Average Income |

| Neurosurgeon | USD 600,387 |

| Anaesthetist | USD 386,065 |

| Internal Medical Specialist | USD 304,752 |

| Financial Dealer | USD 275,984 |

| Psychiatrist | USD 235,558 |

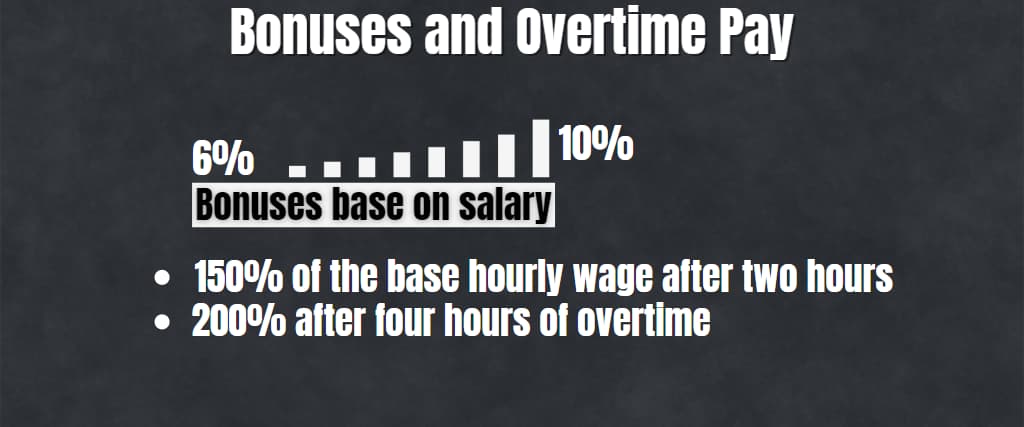

Bonuses and Overtime Pay

Overtime pay for Australian workers is required by law to be 150% of the base hourly wage after two hours and 200% after four hours of overtime. Bonuses vary widely by employer and industry but often range from 6% and 10% of base salary.

Let the ATO know about any additional super contributions, such as bonuses or overtime income, that you receive.

If You Want to Make Do Comfortably in Australia, How Much Should You Make?

The national average cost of living differs for every state and family size. One person would need approximately USD 2,000 and USD 3,537 monthly to survive on a budget (excluding housing costs).

But if you want to live comfortably in Australia, a salary of $4,000 a month will get you there. Renting a studio and spending $200 on groceries and $10 on entertainment should help you on your way to stability.

A family of four in Australia presumably requires a monthly income of not less than USD 6,600 (or USD 4,905 excluding rent) to get by comfortably.

How Acceptable Is an Annual Wage of AUD 100,000?

In most areas of Australia, an income of AUD 100,000 will be more than enough to cover basic expenses.

A salary of $80,000 to $100,000 is sufficient to maintain a comfortable standard of living in Sydney and other major Australian cities. It’s above the norm in that respect.

After paying taxes on a salary of AUD 100,000, you’ll take home about AUD 75,813, or AUD 6,259 per month.

Whether living alone or supporting a family, that sum will allow you to survive comfortably.

Is It Possible to Live Comfortably in Australia Earning AUD150,000?

In Australia, a salary of AUD 150,000 is very successful. It’s an income between the upper middle class and the wealthy. That’s enough money to live comfortably in any part of the world. In 2021, the average annual wage for a full-time worker in Australia was AUD 90,329.

In addition, if your annual household income is AUD 150,000, you are in Australia’s top 10 per cent of earners. With that money, two people can have a great life together without going overboard.

This income level is sufficient for a household with children but leaves little room for savings or discretionary spending. Remember that the average cost of living in major Australian cities is rising far faster than salaries.

What Is the Average Annual Income in Australia?

An undergraduate degree holder in a typical Australian city can expect a middle-class annual salary of roughly AUD 90,000, excluding taxes.

Income varies greatly from person to person, based on factors such as occupation, hours worked, level of education, and, to a lesser extent, geographic proximity.

Australians of different ages, races, and sexes have different median incomes. From this, the median wage in Australia is about AUD 45 per hour.

In Australia, a comfortable standard of living requires an annual household income of at least AUD 50,000. Whereas the best-paid Australians might make up to AUD 136 per hour, the least-paid earn roughly AUD 20.

As a result, earnings in Australia vary widely depending on factors including industry, degree of education, and years of experience.

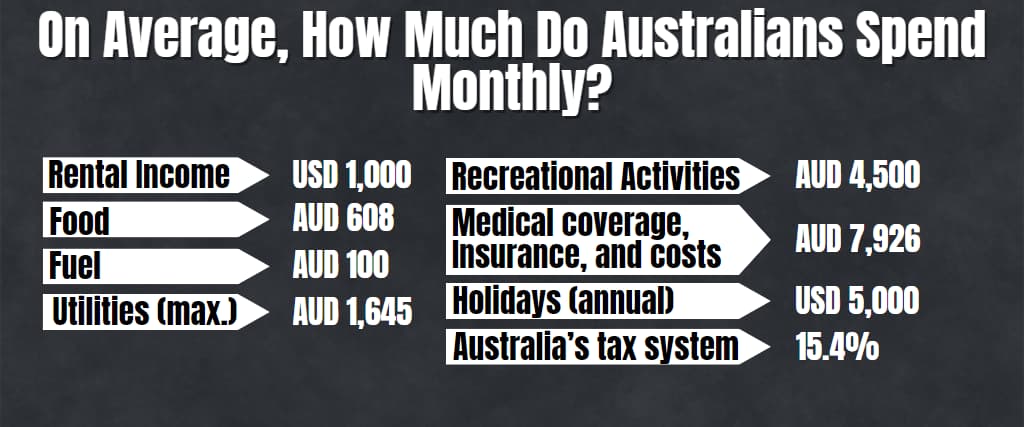

On Average, How Much Do Australians Spend Monthly?

Rental Income

A one-bedroom rental in the heart of a big city will run you at least USD1,000 per month or more.

Mortgage payments for a home purchase can range from $1,728 to $1,993 per month, depending on factors such as the loan-to-value ratio (LTV) and interest rate.

Food

According to recent data, a typical Australian family spends roughly AUD 608 monthly on food. In a mid-range eatery or restaurant, you should expect to pay between $100 and $150 for a full-course meal for a couple. On average, domestic beer costs around $8, while coffee runs around $4.

Fuel

Fuel accounts for the bulk of transportation costs, coming in at about AUD 100 per month in October of 2022 and continuing to rise. For the first time, weekly fuel costs for Australian households topped AUD 100 in August.

The annual average cost of maintaining two cars in a household is AUD 16,912.

Utilities

The standard Australian annual electricity cost is AUD 1,645.

The AUD 250 monthly costs include gas, internet, and water. For example, the monthly cost of an internet connection is AUD 77, the cost of a mobile phone bill is between AUD 50 to AUD 80, and the cost of water is around $200 every quarter.

Recreational Activities

Most of the yearly AUD 4,500 that Australian households spend on entertainment goes toward paying for streaming services and video games. 80% of Australians will have used a video streaming service at least once this year, up from 62% in 2017.

Medical coverage, Insurance, and costs

Health insurance accounts for AUD 166 per month out of the average Australian’s AUD 7,926 annual health care budget.

Holidays

In the last six months of 2020, Aussies expended a mean of AUD 385 on domestic travelling due to closed borders, but this figure increased to AUD 5,072 for international vacations.

While most Australians spend between $4,000 and $5,000 on their annual overseas vacation, there are a few inexpensive countries accessible from the country that could reduce that total.

Australia’s tax system

Australia has a minimum tax rate of 34.5 per cent, and the average tax rate is 15.4 per cent. A yearly salary of $50,000 would result in a tax liability of $7,717.

Income tax and the Medicare contribution total $6,717 at a typical tax rate of 15.4%. If your marginal tax rate is 34.5 per cent, then 34.5 per cent of your one hundred dollars raised will go to the government. This means that your take-home pay will increase by just $65.50.

Taxes in Australia

In Australia, the rate of taxation can be anywhere from 19 to 45 per cent. The higher rate applies to earnings over $180,000.

When compared to most European countries, Australian taxation appears more reasonable. Here is a quick rundown of the four different types of taxes that Australian workers must contribute.

Income Tax

This is Australia’s most important tax income and has three components: income from wages and businesses, income from investment, and income from the sale of assets.

All earned money is subject to income tax, whether wages, business profits, or investment returns. Gains from the sale of property are subject to the same tax.

Tax Relief for the Middle Class and the Poor

The Middle-Income and Low Tax Offset (LMITO) reduces the effective tax rate for Australia’s middle- and low-income earners. This tax fee isn’t a benefit but can eliminate your tax liability. The offset amount is based on your situation.

Here are the requirements to join LMITO:

- You have to be legally able to live in Australia.

- Your earnings are subject to taxation.

- There are minimum income requirements you must meet.

You can reduce the amount of tax you owe by the amount of the offset you receive once you become eligible and submit a tax return.

Medicare

The Medicare tax helps pay for public health programs. Your Medicare tax is typically 2% of your earnings, but you or your spouse may qualify for an exemption or reduced rate. After you submit your tax return, the Internal Revenue Service will determine your Medicare levy.

Employment Taxes

Salary, wage, and tip income are subject to taxation by both the company and the employee. Unemployment Insurance, Medicare, and Social Security are all social insurance systems that get funding from payroll tax.

How much tax a person must pay depends on their income level. Salaried workers, on the one hand, pay a different tax rate than self-employed people.

Foreigners may be subject to different tax rates than locals, depending on their native country.

What Qualifications Are Necessary to Land a Job in Australia?

Here are the fundamentals of working in the country as an immigrant.

1. Obtaining a Visa for Working Holidays

This is an initial and most important need for finding employment in Australia. Work and travel across the country with the flexibility of a one-year working holiday visa. The following are some of the most fundamental requirements for obtaining the visa:

- You need to be an adult.

- You need to show proof that your passport is from a valid country.

- No minors may join you.

2. A Taxpayer Identification Number

You must obtain an income tax registration number to begin employment in Australia. When you start your employment, you’ll be subject to a hefty 46 per cent tax rate if you don’t have a tax file number.

3. A Bank Account in Australia

You can open a bank account online or at a physical branch in Australia. You’ll need a passport number, an Australian address, and proof of job and income to open an account.

In conclusion,

The annual cost of living for a single person in Australia is at least AUD 90,000. The sum varies from person to person, city to city, and family to family.

Finding a job that can pay at least as much as the average wage in the country hourly for your industry, profession, and location is a solid starting point.

FAQs

Is an Annual Salary of $75,000 Considered Good in Australia?

Even though some people make millions of dollars a year, the average salary is only $75,000. When adjusted for inflation, over 70% of taxpayers have incomes below the median. Including retirees in this calculation shows that 80% of Australians have below-average incomes.

Is a Salary of AU$50,000 Fair?

Taking home just AUD 50,000 a year isn’t much. Of course, your location and desired way of life are also major factors. Want to experience life to the fullest? You should aim to bring in at least AUD 150,000 annually.

In Australia, how much income does the middle class earn?

In Australia, the middle-income class comprises about 58% of the population.

Where Does the Middle Class in Australia Typically Fall in Terms of Annual Income?

The middle class in Australia typically earns between $46,000 and $140,000 a year.