For thousands of years, beer enthusiasts have gathered around fires to bond and build strong communities, promoting well-being. You’ve likely spent time with loved ones at local bars, enjoying life, improving your social connections, and winning a trivia night or two while sipping on a pint.

In the following sections, we’ll provide fascinating statistics about the Australian beer market to inform you about the most popular drink globally. Let’s dive into the world of brewing!

Top Ten Beer Facts

- In 2019, Australia produced 16.1 million hectolitres of beer.

- The per capita consumption of full-strength beer in 2018 was 64.4 litres.

- The average price of beer in Sydney is $4.46.

- In 2020, 6,878,000 Aussies drank beer.

- As of June 2020, there were 294 registered independent breweries in Australia.

- 85% of the beer sold in Australia is domestically produced.

- Almost 70% of Australians purchase their craft beer from specialty stores.

- Black Hops is the top-rated Australian craft beer brewery.

- The top craft beer in Australia in 2020 was Be Nice Rewind.

- The Independent Brewers Association (IBA) unveiled its Independence Seal in May 2018.

General Beer Statistics

1. Australia produced 16.1 million hectolitres of beer.

According to recent research, Australia produced over 16 million hectolitres of beer in 2019, making it the largest beer industry in the Oceania region. This is significantly more than the second-largest beer manufacturer, New Zealand, which produced 2.95 million hectolitres. Papua New Guinea ranked third with 800 thousand hectolitres, while all other Oceania countries had a much smaller beer output.

2. 34.6% of Australians consumed beer in an average four-week period in 2020.

The latest analysis of the Australian beer market by Roy Morgan shows that in 2020, 34.6% of Australians consumed beer in an average four-week period. While this represents a decline of 2.8% from the previous year, beer remains the second-most popular alcoholic beverage in Australia. However, the number of consumers purchasing spirits increased to 31.5% in 2020, and if this trend continues, it may overtake beer drinkers in 2021.

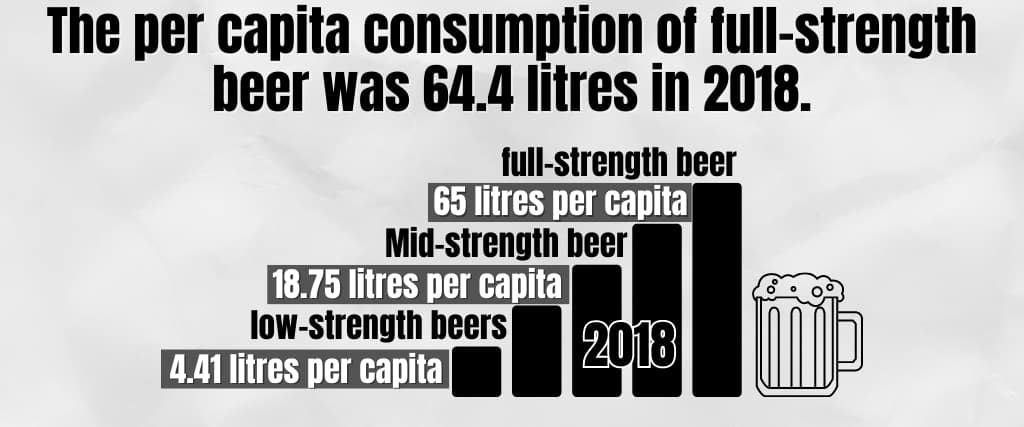

3. The per capita consumption of full-strength beer was 64.4 litres in 2018.

In 2018, full-strength beer was the most popular beer in Australia, with an average consumption of almost 65 litres per capita. Mid-strength and low-strength beers were significantly less popular, with yearly averages of 18.75 and 4.41 litres consumed per person, respectively.

4. The cost of beer in Sydney is relatively high.

In Sydney, beer costs $4.46, which is relatively high compared to other cities worldwide. A study conducted by the Wall Street Journal found that the average supermarket price for beer in Sydney is $2.37, while the bar price is $6.56, which is higher than the median line of all surveyed cities.

However, almost 20 cities out of the 75 surveyed have higher beer prices than Sydney. Geneva and Hong Kong have the highest average beer prices at $6.32 and $6.16, respectively, while cities in Eastern Europe, such as Kyiv, Kraków, and Bratislava, have the lowest beer prices.

5. Bars and pubs are the consumers’ favourite beer takeaway spots.

Bars and pubs are the preferred takeaway spots for beer consumers, with 41% of respondents purchasing craft beer in Australia. Restaurants are the second most popular spot with 12% of all votes, while only 4% and 3% of respondents order a beer at cafes and clubs, respectively. Each state in Australia has its favourite watering hole for enjoying a beer or two.

6. 9% of beer fans say they prefer to hear podcasts on beer.

Radio Brews News was the most popular craft beer podcast in 2020 among Australian beer enthusiasts. 9% of beer enthusiasts prefer listening to podcasts about beer. The top five most popular beer-related podcasts include:

- Ale of a Time

- Black Hops Operation Brewery

- The Inside World

- Beer Healer Interviews

7. In 2020, almost 6.88 million Australians drank beer.

A recent Roy Morgan study indicated a significant decline in beer drinking compared to 2019 when over 7.4 million consumers purchased beer in Australia.

8. Australians have been drinking craft beer for more than six years, at a rate of 59%.

The Australian craft beer market has some of the most dedicated consumers worldwide, with 59% of Australians drinking craft beer for over six years. The survey conducted with 17,000 respondents found that around a third of craft beer consumers have been drinking this type of brew for 6-10 years, while 26% have been consuming it for at least 11 years. On the other hand, 2% of craft beer consumers have only declared one year of drinking experience, while 9% have been imbibing it for 1 to 2 years.

9. Aged 30-39 comprised 39% of craft beer enthusiasts in 2020.

About two-fifths of craft beer consumers in 2020 were between 30 and 39, with 40 to 49-year-olds coming in second with 26%. Craft beer is less popular with the younger generation (18 to 29) and older consumers above 49, both of which are represented with a more or less equal share.

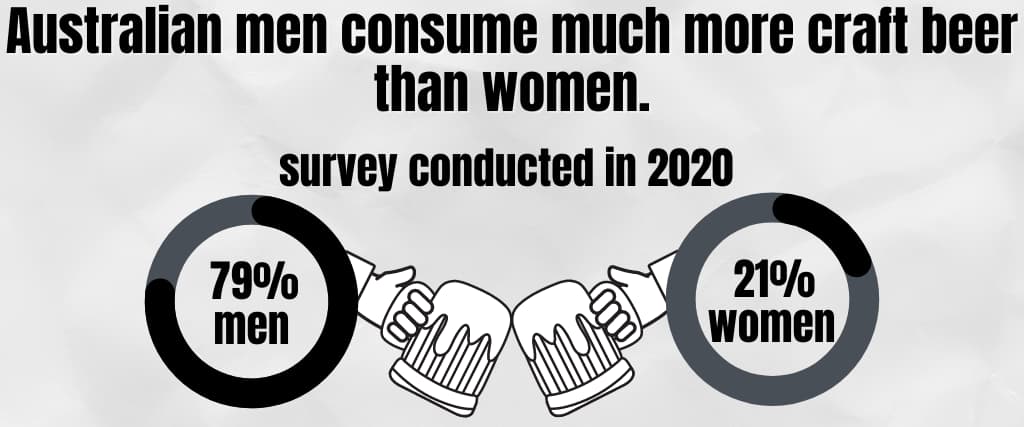

10. Australian men consume much more craft beer than women.

In recent years, this has been a consistent trend. The survey conducted in 2020 revealed that 79% of craft beer lovers were men, and only 21% were women. This gender gap’s potential cause may be related to the cultural connotation of masculinity and beer consumption.

11. 54% of Australians who consume craft beer come from New South Wales and Victoria.

More than half of Australia’s microbrew drinkers are based in New South Wales and Victoria, accounting for 54% of the total microbrew drinkers. Queensland also has a significant share of 24%, while the remaining states comprise the remaining 23%. The Northern Territory and Tasmania have the smallest representation, with only 1% and 2%, respectively.

12. As of June 2020, 294 independently owned breweries were registered in Australia.

New South Wales had the highest number of operational breweries, with 99, followed by Victoria with 83 and Queensland with 47.

13. The Australian Capital Territory and the Northern Territory had the fewest independent breweries in 2020.

The Northern Territory and the Australian Capital Territory had the fewest independent breweries in operation as of June 2020, with only three in total. Tasmania had the highest number of independent breweries, with 13, followed by Western Australia with 20 and South Australia with 26.

14. In 2018/19, independent breweries provided 5.9% of the market’s volume.

According to the Independent Brewers Association’s 2018/19 report, the independent craft beer industry is expanding. In 2011, Australian microbreweries had a market volume share of just over 1%, growing to nearly 6% by 2019. Furthermore, the market volume percentage of independent beer grew by almost 25% between 2017 and 2019.

15. 36.9% of the value share of craft beer comes from independent breweries.

Per the same IBA report, nearly 37% of the total value share of craft beer in 2018/19 came from indie Australian beer companies. Nonetheless, major craft breweries had the 57.2% majority, with private labels making up the remaining percentage.

16. In Australia, domestic brewing accounts for 85% of the beer sold there.

The Australian Brewers Association reported that domestically produced beer accounts for 85% of the beer sold in Australia, generating approximately $16 billion in economic activity. This industry supports other major sectors, including materials and packaging, marketing and sales, transport and freight, ingredients/agriculture, and administration.

17. In 2018, the Australian economy benefited by $4.6 billion from beer production.

The beer industry contributed $4.6 billion to the Australian economy in 2018, with Queensland and Victoria generating the highest revenues of $1,765 million and $1,361 million, respectively. The Northern Territory and Tasmania had minimal contributions of $29 million and $105 million, respectively.

18. About 102,820 individuals had jobs provided by the beer sector in Australia.

In 2018, the Australian beer industry employed 102,820 workers, with the majority working in restaurants, cafes, pubs, and clubs (46,820) and other types of retailers and related businesses (43,440). The remaining workers (12,560) were employed in various beer manufacturing sectors.

19. In 2020, the cost of producing a 24-pack of 330ml beer bottles was about $40.

The production costs for a 24-pack of 330ml beer bottles in Australia vary depending on the brewery, but Black Hops, an independent brewery, estimated their production costs to be around $40 per pack.

The most costly phase in their production is canning, costing $9,547 per batch. This is followed by ingredients ($5,613), wages ($1,085), and packaging and warehousing($1,185). These expenses added up to $39.75 per 24-pack carton or $17,430 per batch of pale ale, excluding potential profit margins and bottle shop markup charges.

20. In 2019, Great Northern Brewery beer was the most popular in Australia.

Great Northern Brewery and Carlton were Australia’s two most popular commercial beers, according to a 2019 survey that looked at beer sales by brand; each had a 12% share of the overall market. XXXX had a market share of 9.2% for the third most popular beer that year, followed by Victoria Bitter, with a market share of 7.3%.

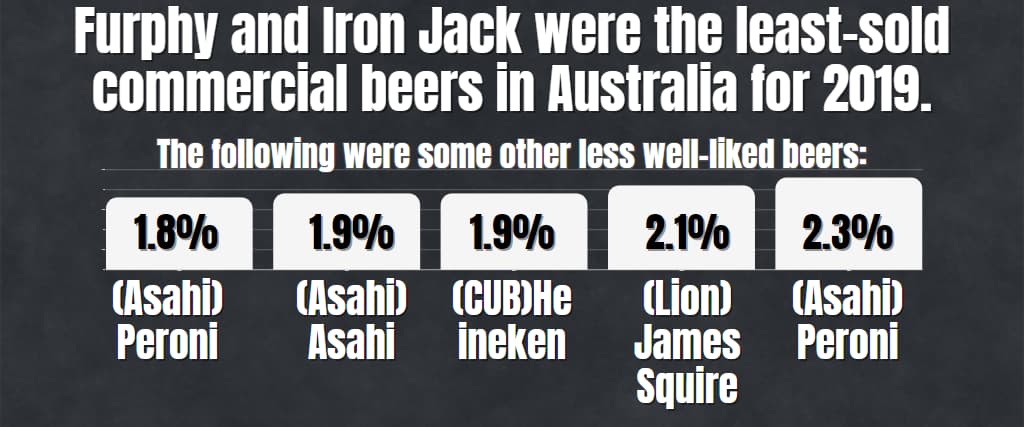

21. Furphy and Iron Jack were the least-sold commercial beers in Australia for 2019.

At 1.7% and 1.8% of the market, respectively, Furphy and Iron Jack had the lowest market shares. The following were some other less well-liked beers:

(Asahi) Peroni—1.8%

(Asahi) Asahi – 1.9%

(CUB)Heineken —1.9%

(Lion) James Squire—2.1%

(CUB) Pure Blonde—2.3%

This investigation excluded the remaining 23% of the Australian beer market, which includes craft beer, among other brands.

22. In 2019, CUB was Australia’s most dominant beer manufacturer.

Two major breweries — Carlton United Breweries (CUB) with a 53% share and the Kirin Group with a 47% share — controlled the majority of the inexpensive beer industry in Australia in 2019.

The majority of the most well-known mainstream beers were also produced by CUB, which produced over 50%. Nonetheless, the Kirin Group (27%) and other breweries (22%) produced roughly similar amounts of the remaining popular beer brands.

23. CUB also produces a sizable amount of super and premium beer.

CUB likewise dominates the premium and super-premium beer market sectors in Australia. The Kirin Group only has a sizable presence in the premium beer market category, with a share of 29%, whereas CUB rules the beer industry overall.

24. In 2020, 39% of Australians spent between $26 and $50 per week on alcohol.

According to the most recent data on beer sales in Australia, about 40% of Australians spend at most $50 per week on beer, with around a third reporting weekly beer expenditures between $51 and $100. In contrast, 17% of respondents said they spend little more than $25 per week on beer, and about 10% said they spent more than $100 per week.

25. Australia’s population of almost 90% drinks pale ale.

According to a market analysis of the Australian beer business, in 2020, about 90% of Australians preferred pale ale or extra pale ale beers. Of the respondents, 84% also bought double IPA or India pale ale brews.

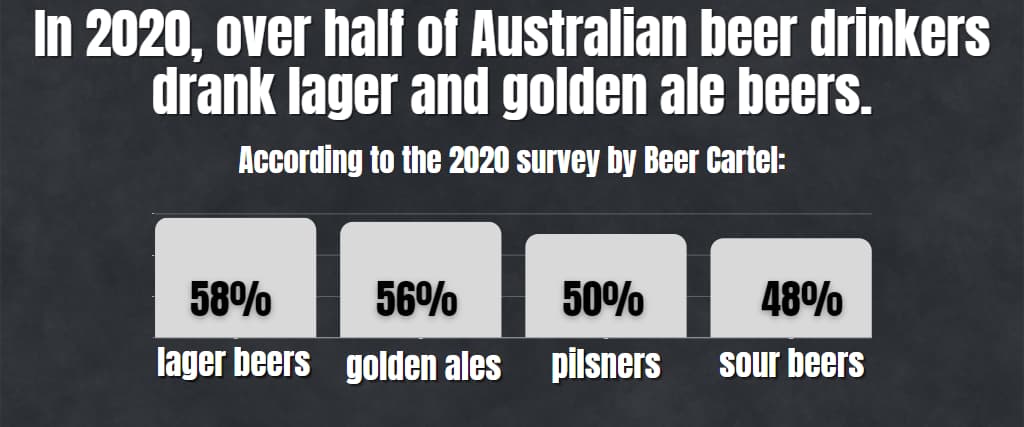

26. In 2020, over half of Australian beer drinkers drank lager and golden ale beers.

Over half of Australian beer drinkers chose lager and golden ale beers in 2020, making them less popular. According to the 2020 survey by Beer Cartel, 58% of respondents consumed lager beers, while 56% enjoyed golden ales. However, pilsners (50%) and sour beers (48%) were the least preferred.

27. 84% of beer enthusiasts buy microbrews at mainstream liquor stores.

In the 2020 Beer Cartel study, nearly 85% of respondents said they get their craft beer from traditional liquor outlets in Australia. Most respondents (52%) claimed they get it weekly, (22%) fortnightly, and (23%) monthly. The remainder said only to buy craft beer occasionally—every two to three months or once a year.

28. Around 70% of Australians purchase craft beer from specialist shops.

To find the most excellent craft beer in Australia, many Australians also use the services of specialised craft beer shops. Most customers who buy craft beer do so on a weekly (18%), monthly (18%), or biweekly (17%) basis.

29. Craft breweries and internet retailers are the least preferred sources of craft beer.

Australian beer drinkers can also purchase their craft brews at the following locations in addition to the ones mentioned above:

59% of consumers frequent craft brewers (19% monthly, 15% every 2-3 months, 11% fortnightly, and 8% weekly).

Consumers spend 38% of their time online (3% weekly, 10% monthly, 12% every 2-3 months, , and 7% every six months).

30. The top-rated Australian craft beer brewery is Black Hops.

According to participants in a most recent survey, Black Hops is the best microbrew in Australia. For the first time, Black Hops grabbed the top rank, passing Balter (2nd place), Bentspoke (3rd place), and Stone & Wood (4th place). Deeds is another craft brewery worth mentioning because it moved 114 points to claim fifth place.

31. The best craft beer in Australia for 2020 is Be Kind Rewind.

Be Kind Rewind received a 4.27 out of 5 rating in a March 2021 study, making it the best-rated craft beer in Australia. Tusk was ranked third, while Survivor Type and Once more Into The Fray tied for second place with a score of 4.2. The following is a list of further top-rated Australian craft beers:

- Relax Clout Stout- 4.18

- Double Juice Train- 4.16

- Citra Feels- 4.16

- Supertrooper- 4.16

- Viper Pit- 4.15

- I’m A Regular Here- 4.18

32. Heineken received the highest quality score in Australia in 2019.

According to a survey conducted in April 2019, of all beers offered on the Australian beer market, Heineken was regarded as having the highest quality by beer drinkers.

As the negative feedback is deducted from the positive, the quality score runs from -100 to 100. Heineken is ranked second with a score of 27.8, followed by Corona (24.4) and Stella Artois (18.1). Below are other beer brands associated with excellent quality:

- Great Northern—13.9

- Asahi—15

- James Squire—14.4

- Crown—16.7

- Peron—16.35

- Little Creatures—15.6

- Coopers—14

33. 2019’s best value for money rating went to Carlton Draught.

Consumers were asked which beer offers the best value for money in the same survey on the top-selling beers in Australia. Carlton Draught received a score of 12.6 from Australians, making it the best option.

Great Northern came in third with a score of 9.3, while Heineken came in second with a score of 10.8. Below are the rankings for the remaining seven out of ten positions:

- Pure Blonde — 4.9

- Stella Artois — 5.6

- Pure Blonde — 4.9

- Cascade — 5.4

- Corona — 8.2

- Hahn — 8.1

- Furphy — 6.2

- Crown — 5.1

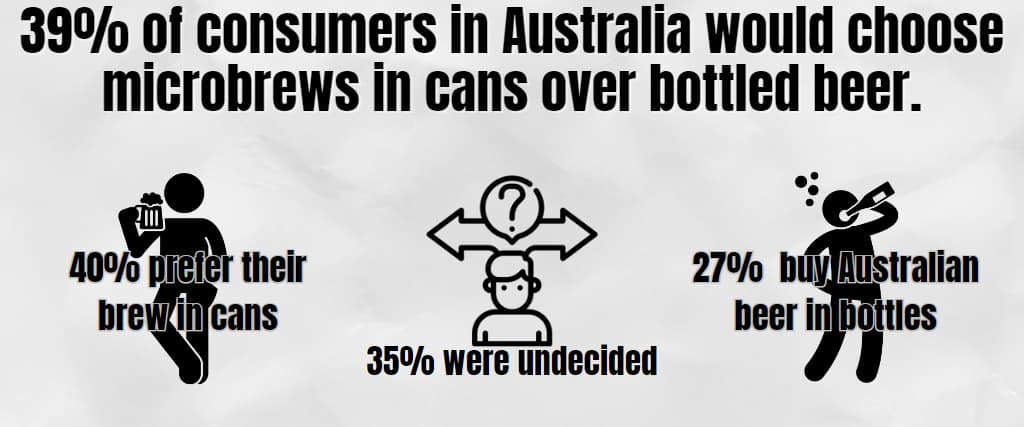

34. 39% of consumers in Australia would choose microbrews in cans over bottled beer.

Over 40% of microbrews drinkers prefer their brew in cans, according to a recent study on their buying preferences. In contrast, 27% of respondents said they buy Australian beer in bottles, and the remaining 35% were undecided.

35. The main factor influencing Australians’ preference for alcohol delivery services is convenience.

Due to several factors, such as internet discounts or a lack of time, many Australians also get their beer through delivery services.

For example, according to 31% of consumers who responded to a 2020 survey about the benefits of alcohol deliveries, they prefer the ease of having their purchases delivered right to their homes.

Additionally, more than a quarter of respondents claimed that purchasing alcohol in quantity online was just more cost-effective and offered greater value.

36. The key to a successful beer festival is the opportunity to sample different brews.

The primary factors driving people to attend beer festivals are also revealed by Beer Cartel’s 2019 analysis of craft beer consumption trends in Australia. About 90% of respondents stated that the main draw of beer festivals is the chance to sample new beers.

About two-thirds of beer consumers also said festivals are a good value overall and provide excellent cuisine. The least significant factors for attending beer festivals were entertainment events (6%) and non-beer drink options (7%).

37. The Independent Brewers Association (IBA) unveiled its Independence Seal in May 2018.

They were motivated by the latest Australian beer market analysis, which revealed that almost every beer drinker is happy to buy from independent Australian brewers.

The IBA unveiled the Independence Seal in May 2018. The association’s seal is intended to set smaller, locally-owned breweries apart from well-known global businesses. This emblem is displayed on the packaging of all eligible independent breweries in Australia who apply for it.

38. There are currently 570 members of the IBA.

The Independent Brewers Association, founded to provide independent breweries in Australia a voice, presently has 570 members, of which 385 are breweries, 100 are associate members, and the remaining members are supporters.

39. In 2020, 60% of people were aware of the IBA Independence Seal.

In Australia, over two-thirds of microbrew drinkers said they know the IBA seal, up 27% and 19%, respectively, from 2019 and 2018. Increased sales of homebrewed craft beer are anticipated in the years to come due to the significant improvement in these numbers.

40. According to a 2020 survey, 82% of participants have heard of independent beer.

In the 2020 edition of the yearly Beer Cartel survey, participants were asked if they understood what “independent beer” meant. Consumer opinion of independent Australian beer brands has significantly improved since prior years.

For example, over 80% (an increase of 4% over the prior year) of beer consumers stated that “independent breweries make independent beer”. The following other adjectives saw a spike in popularity:

- Designed, not produced — 55% (up 7%)

- Australian-owned and manufactured, at 53% (up 10%).

- Helps small businesses — 52% (an increase of 10%)

- An improved beer — 42% (up 14%)

41. 52% of Australians aware of the Independent Brewers Seal claim to make every effort to purchase beers bearing it.

Since independent brewers depend on consumer support to keep raising the calibre of their beers, more than half of Australian beer enthusiasts who purchase craft beer in Australia stated that this encourages them to buy Aussie beer companies bearing the logo. Similarly, about 9% of those surveyed claimed to be highly persuaded only to purchase beers with the seal. The remaining 39% said they needed more convincing to seek out beers with the IBA logo.

42. More than two-thirds of consumers purchase six-packs of microbrew.

When asked which package type they prefer to buy microbrew in Australia, 68% of respondents stated they typically buy six-packs, while 54% added that they also buy cases of 24 beers. On the other hand, four-pack packaging (38%) and cases of 16 (42%) were the least preferred package types among beer drinkers.

43. In the core range, 52% of beer drinkers made weekly or biweekly purchases.

Beer Cartel found that more than half of its current consumers prefer to purchase core range beers on a fortnightly or weekly basis, while more than a third do so every few months.

Customers are less inclined to sample new and limited-release beers regularly. For instance, just 26% of respondents indicated they would like to purchase a limited or new Australian beer every week or twice a month. Instead, fresh craft beers are bought once a month or occasionally.

44. Four- or six-packs purchase more than 55% of core range beers.

Core range beers are typically bought in bigger packaging types like four- or six-packs (56%) and by the case (37%) due to their already-established reputation. On the other hand, new brews still need beer enthusiasts’ trust. As a result, they can be purchased in four- or six-packs (47%) or singly (47%).

45. Beer enthusiasts are overwhelmingly happy about introducing new beer products.

When a new craft beer in Australia enters the market, beer lovers are typically thrilled. According to a 2019 Beer Cartel survey, 63% of craft beer lovers say they can always find something new and intriguing to sample.

More than two-thirds believe that new releases demonstrate breweries’ innovation. About half of those surveyed also mentioned that they like introducing new beers to others.

Nonetheless, only a small percentage of the consumers who participated in the survey had negative opinions about fresh craft beer releases. For example, only 5% of respondents think introducing new beer products will lower beer’s general quality and local beer brewers’ revenue.

46. Most beer drinkers are pleased with how local breweries in Australia are doing.

85% of consumers were interested in the future of craft beer when asked about the development of Australian brews. Nonetheless, 76% of respondents think that for independent brewers to remain in business, beer drinkers must support the brewery’s core product lines. Also, two-thirds of respondents stated they like experimenting with the newest craft beer trends.

47. Since Covid-19 began, there has been an increase in support for Australian artisan brews.

Australia’s independent breweries have received overwhelmingly positive support due to public understanding of Covid-19’s effects on the country’s craft beer business. For instance, according to 93% of respondents to Beer Cartel’s 2020 study, independent Australian brewers require customer support now more than ever.

48. During COVID-19, many Australians have been buying craft beer.

The socioeconomic changes brought on by the Covid-19 pandemic have impacted Australia’s beer industry, as shown by the numerous changes in national drinking patterns. For example, a significant net difference of 30% has been observed in favour of buying regional craft beer instead of imported or mainstream beer.

49. During the Covid-19 lockdowns, the Australian beer market had a spike in spending on beer products by 13%.

The purchasing habits of beer drinkers were dramatically impacted between April and May 2020. While 27% of beer enthusiasts reported lower weekly beer expenses, 40% of drinkers stated they increased their weekly beer consumption.

When accounting for the 33% of consumers who continued to shop in the same way, the overall net adjustment resulted in a 13% rise in beer consumption in Australia for the peak Covid-19 month.

50. Australian brewers produced 44% less beer volume in April 2020 than in the previous year.

Breweries in Australia recorded a value loss of 55% for April 2020 while operating at practically half their capacity. However, with a volume fall of 19% and a value reduction of 26% from the 2019 estimates, beer production and predicted value both started to improve in May 2020.

51. Convenience was a factor in 64% of Australian customers’ decisions on where to purchase craft beer in April 2020.

During the busiest Covid-19 season, almost two-thirds of Australians who enjoy beer chose a location nearby and practical for shopping.

According to nearly half of all respondents, a wide selection of products is also a crucial consideration when selecting a beer shop. The following list summarises the other vital elements that Australian beer drinkers considered when making their purchasing decisions during the Covid-19 lockdowns:

- My favourite of them — 35%

- They are native — 34%

- Purchase ease — 31%

- Pricing — 30%

- Location of a store or venue — 28%

- Current customers — 26%

- Cost of delivery — 18%

52. During the peak of Covid-19, online sales increased by 18%.

During the peak of Covid-19, consumers flocked to online retailers for a consistent supply of Australian beer brands, increasing their sales traffic by about 20%. Although it increased by only 1% after the lockdown, this shopping pattern did not last and returned to its pre-Covid-19 levels.

The same survey also revealed that mainstream liquor outlets lost the trust of beer enthusiasts, with a 7% decline in sales following the peak of Covid-19 and a 1% decline during that period. During the lockdown, specialist craft beer shops saw no changes; however, beer sales increased by 1% after the peak.

53. Online beer sales in Australia have significantly increased in frequency thanks to Covid-19.

Online beer shopping has become one of Australians’ new favourite pastimes in both commercial and craft beer.

Due to the limitations and procedures in place due to Covid-19, 53% of beer drinkers reported buying alcohol online between April and September 2020. However, that proportion was at most 38% before Covid-19.

More and more beer enthusiasts in Australia buy commercial and craft beer through internet retailers. For example, 28% of respondents—up 14% from the prior year—said they had purchased beer from significant brewery websites.

Likewise, craft breweries experienced a surge in traffic to their niche websites, offering their products to 27% of all surveyed beer enthusiasts, up from 19% in 2019.

Bottom Line

You’ve undoubtedly discovered that Australians enjoy drinking beer from reading the above statistics and facts. Beer drinkers managed to get their fix despite the limitations brought on by Covid-19 by ordering from online beer marketplaces and various delivery providers.

The nation’s brew ladies and gentlemen have also demonstrated greater support for locally based Australian microbreweries because they provide better taste and quality commercial beer. The beer industry is anticipated to stabilise as Australia recovers from the pandemic’s effects.

The introduction of new drinking habits that encourage the adventurous Australian to try a variety of different home-brewed beers will also help independent brewers to continue prospering.

The data on the Australian beer market should inspire you to purchase locally the next time you go out for a few drinks.